Inflation cooled in February as the impact of the Brexit-hit pound on everyday prices began to “work through the system”.

Figures from the Office for National Statistics (ONS) show the Consumer Prices Index (CPI) eased to 2.7% last month, down from 3% in January.

The outcome was lower than the 2.8% predicted by economists and marked the first fall in inflation since December last year.

Sterling’s slide since the Brexit vote has ratcheted up the pressure on household spending power, climbing from 0.6% shortly after the EU referendum result to a near six-year high of 3.1% in November 2017.

Slower growth from CPI eases the pressure on the Bank of England, which is widely expected to hike interest rates beyond 0.5% in May.

Phil Gooding, ONS head of CPI, said: “A small fall in petrol prices alongside food prices rising more slowly than last year helped pull down inflation, as many of the early 2017 price increases due to the previous depreciation of the pound have started to work through the system.

“Hotel prices also fell and the cost of ferry tickets rose more slowly than last year, when prices were collected on Valentine’s Day when many people could have been taking mini-breaks.”

Transport prices dragged on the cost of living in February, securing a smaller month-on-month rise of 0.5% in contrast to 1.2% last year.

Petrol prices dropped by 0.2p per litre to 120.8 per litre on the month, while diesel slipped by 0.1p per litre to 124.4p per litre.

Food prices were also applying downward pressure, lifting 0.1% between January and February in contrast to a 0.8% rise the year before.

The fall in food prices was partly down to a shortage of salad and vegetables last year when bad weather hit crops in southern Mediterranean countries, the ONS said.

The main upward pressure on the cost of living came from clothing and footwear prices, which rose by 1.7% on the month – compared to 1.2% in 2017 – as women’s shoes became more expensive.

Economists and the Bank believe inflation’s upward march has run its course and will start to unwind over the coming months.

The Bank is expected to keep interest rates on hold at 0.5% on Thursday, but the meeting will be watched closely amid expectations over another hike in May.

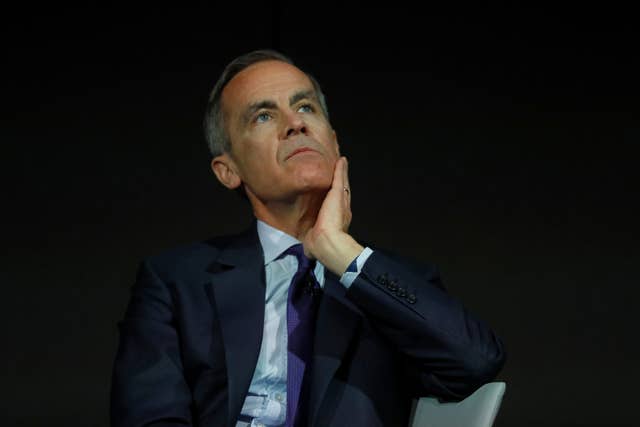

Governor Mark Carney has already warned borrowers that rates will need to rise “somewhat earlier and by a somewhat greater degree” to get inflation back to the Bank’s 2% target after stronger-than-expected economic growth.

It comes after the Office for Budget Responsibility (OBR) hiked its outlook for economic growth this year to 1.5% from 1.4% in its Spring Statement forecasts.

It also said it believed inflation would fall back to target this year.

The Retail Prices Index (RPI), a separate measure of inflation, was 3.6% in February, down from 4% in January

The Consumer Prices Index including owner-occupiers’ housing costs (CPIH) – the ONS’ preferred measure of inflation – was 2.5% last month , down from 2.7% the month before.